持續變化的PC市場

Table of Contents

過去10年的全球PC市場其實是一個與過去不同的樣貌,但也維持著當前的模式。未來10年會如何轉變?新的趨勢、動能和關鍵在哪裡?

看看 Google 的 Gemini 怎麼分析?以及來自AI的預測。

若要觀看 Gemini 產生的互動版本摘要,請直接透過下方連結進入。

The Global PC Wars 2014-2024

Decade analysis of revenue, market share, and strategic shifts among the "Big 6" tech giants.

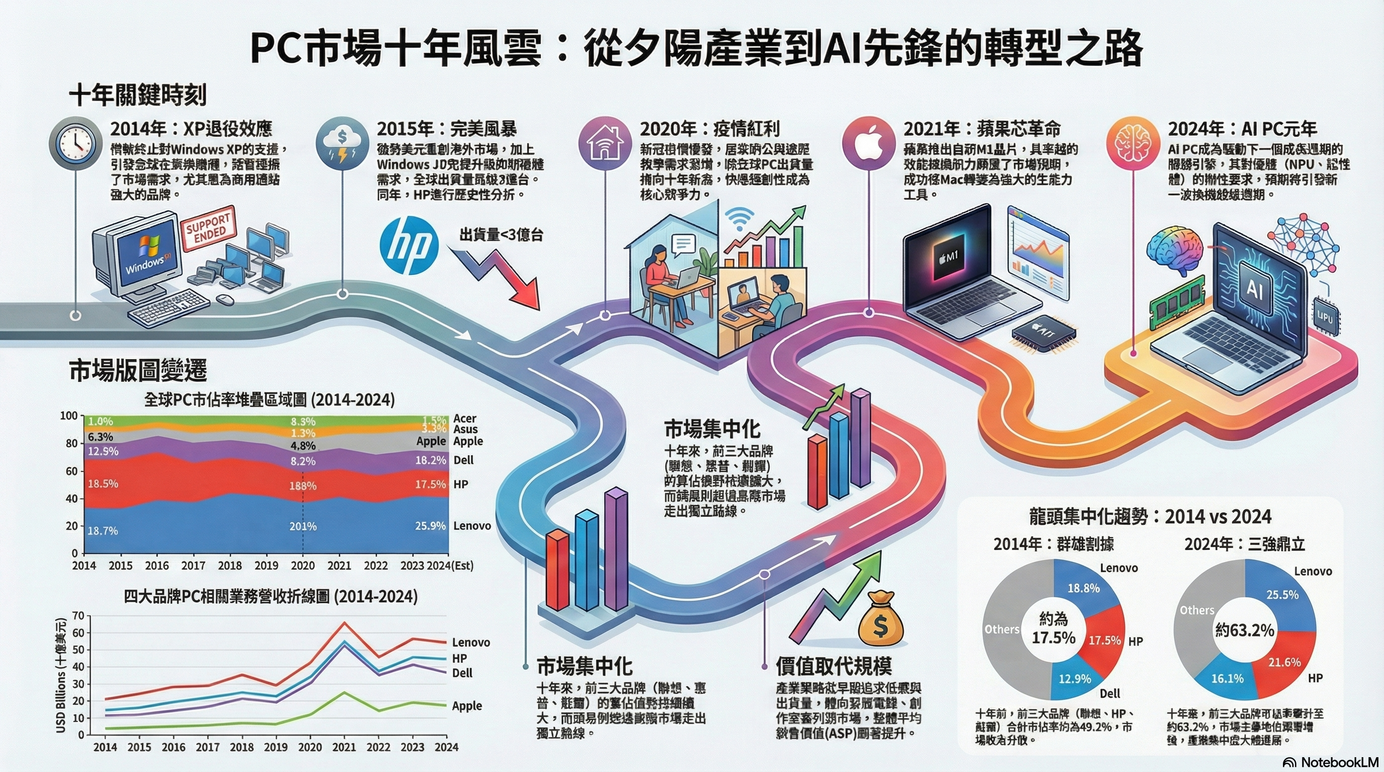

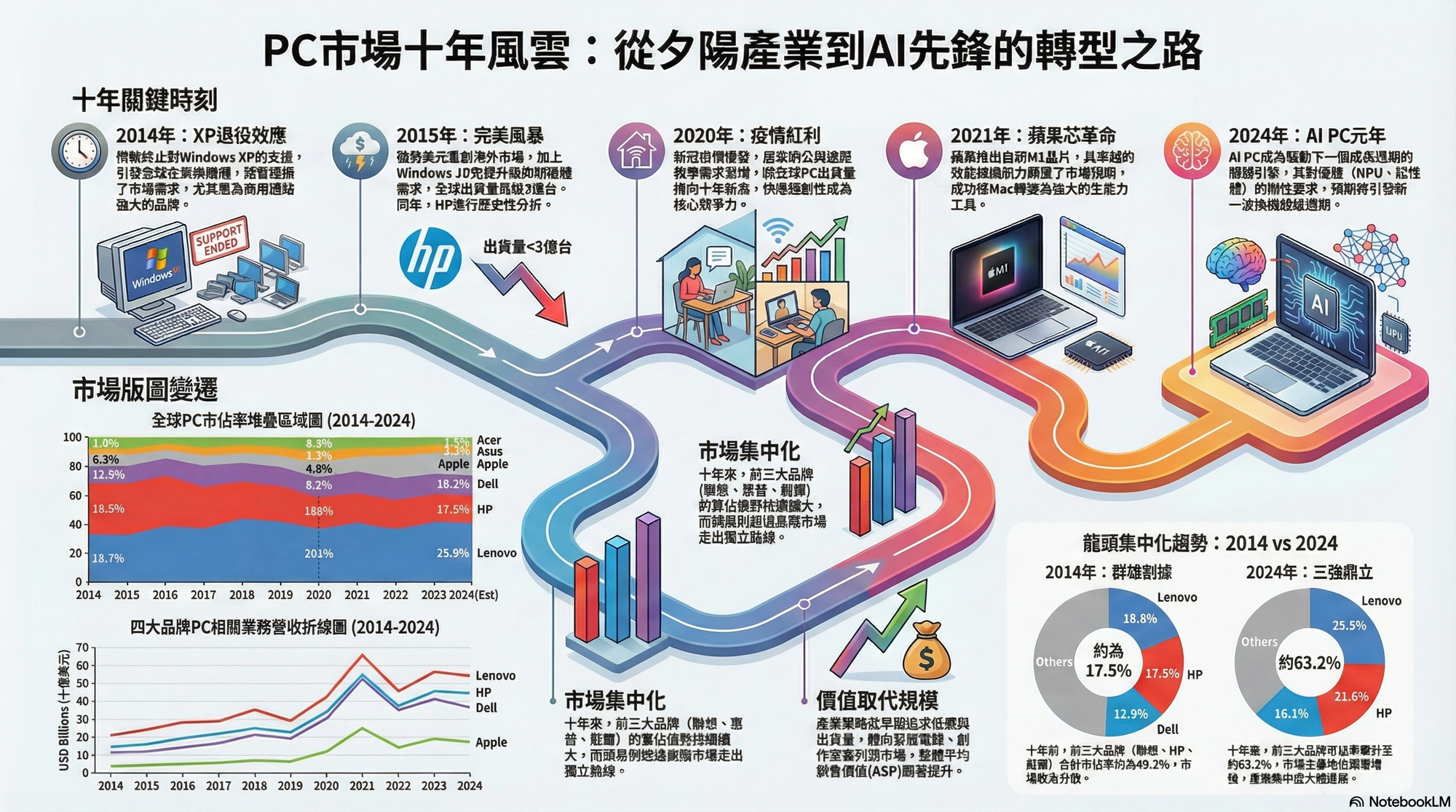

The Era of Consolidation

Between 2014 and 2024, the Personal Computer market underwent a massive transformation. What was once a fragmented battlefield has consolidated into a dominance by the "Big Three"—Lenovo, HP, and Dell. Despite the rise of mobile computing, the PC market proved resilient, exploding during the COVID-19 pandemic before facing a correction in 2022-2023. This infographic explores how Lenovo captured volume leadership, how Apple cornered profitability, and how Asus and Acer fought to maintain relevance in a specialized market.

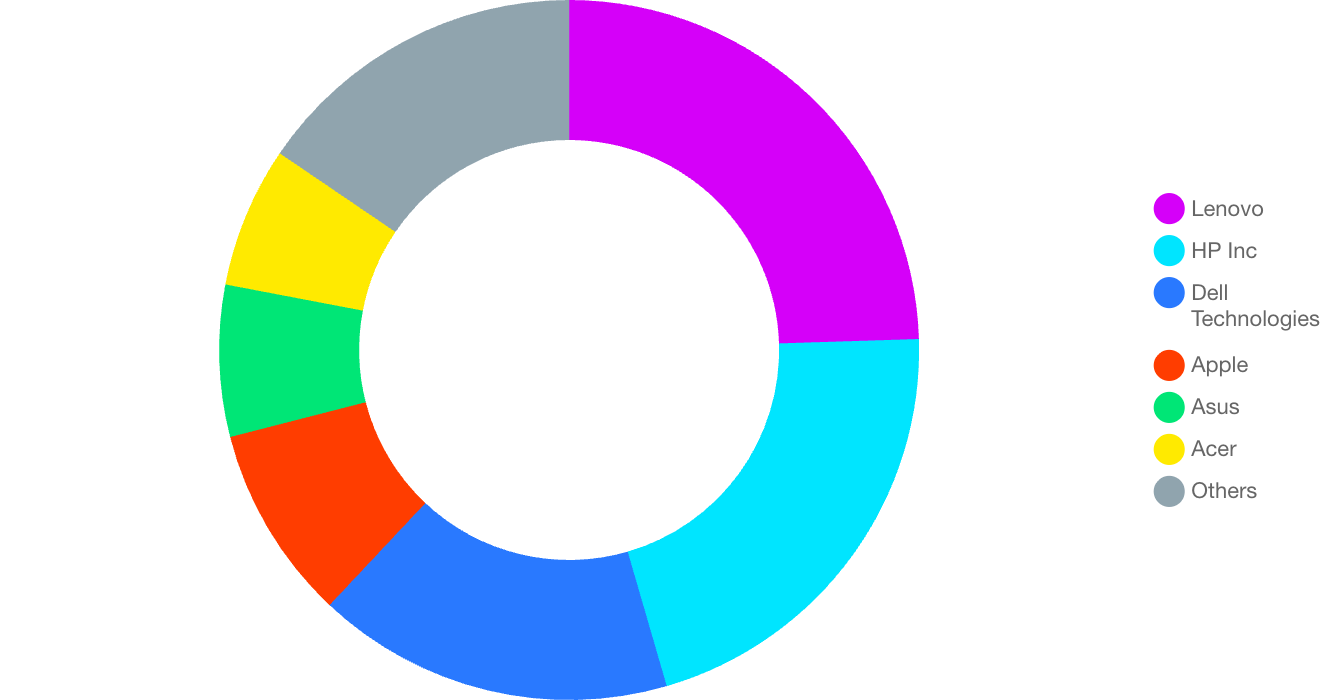

Current Landscape (2024)

As of 2024, the market is heavily top-heavy. Lenovo remains the undisputed king of volume, capturing nearly a quarter of all global shipments. HP and Dell follow, driven by strong enterprise contracts. Apple holds a smaller slice of the pie by unit count, but as we will see later, their revenue story is vastly different.

24.5%Lenovo's Market Share

2024 Global Market Share Distribution

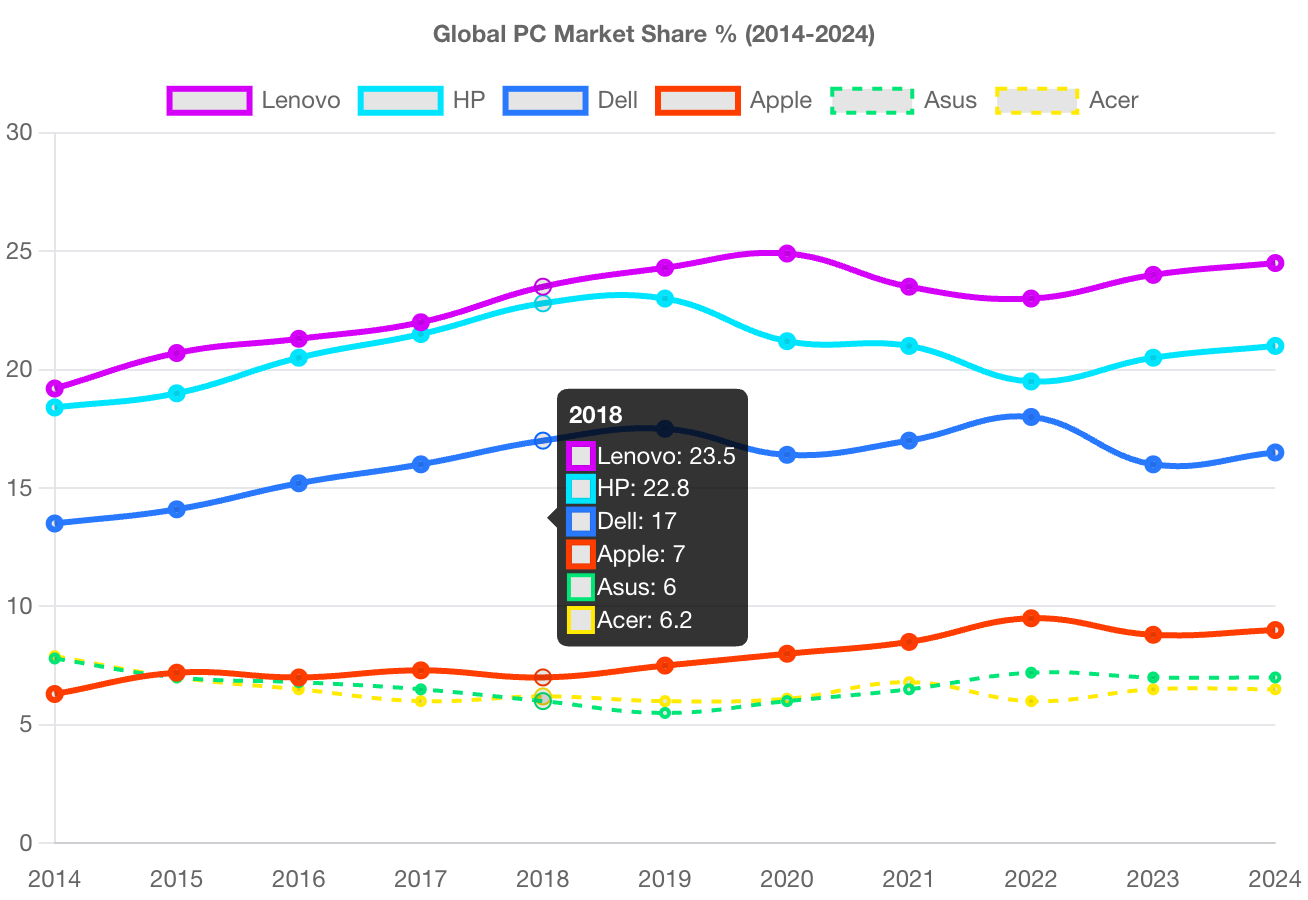

The 10-Year Trend: Rise of the Giants

Tracking the market share from 2014 to 2024 reveals a clear divergence. The "Big Three" (Lenovo, HP, Dell) steadily grew their combined share from roughly 55% to over 65%. Meanwhile, Apple saw slow but consistent growth, driven by the success of Apple Silicon (M-series chips) post-2020. Asus and Acer have faced squeezed margins, stabilizing around 6-7% each.

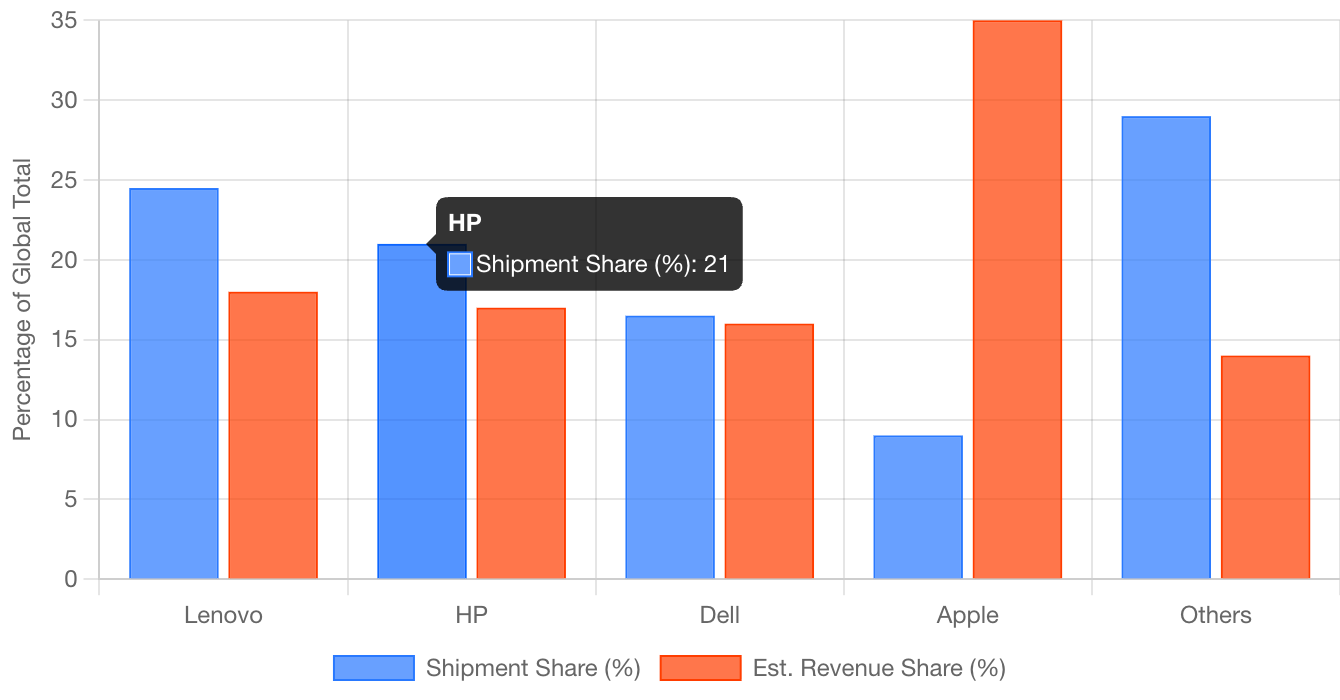

The "Apple Paradox": Volume vs. Revenue

Market share by units shipped tells only half the story. While Lenovo ships the most boxes, Apple dominates in revenue and profit. By focusing on the premium segment ($1000+ devices), Apple generates nearly as much revenue as the volume leaders despite shipping fewer than half the units.

Strategic Divergence

Brands have adopted distinct strategies to survive the decade:

- ♕Lenovo & HP:Focus on scale and broad portfolios, ranging from budget education laptops (Chromebooks) to high-end workstations.

- ⚡Dell:Master of the supply chain and enterprise sales. Dominates the corporate office environment.

- 💎Apple:Low volume, high margin. Transition to proprietary M-series chips in 2020 revolutionized their performance-per-watt advantage.

- 🎮Asus & Acer:Heavy reliance on the gaming niche (ROG, Predator) and value segments to maintain visibility against the giants.

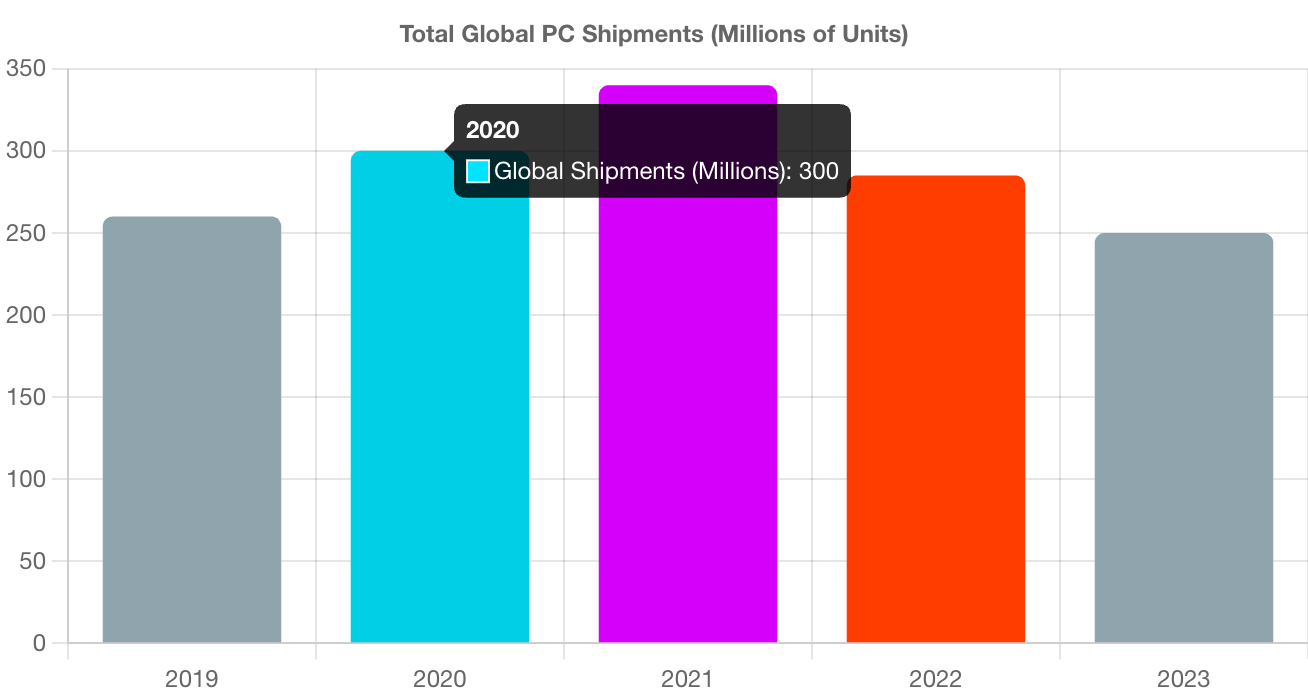

The Pandemic Rollercoaster (2019-2023)

The years 2020 and 2021 saw unprecedented demand due to the global shift to Work-From-Home (WFH) and remote schooling. Shipments surged to decade highs. However, this pulled forward demand, leading to a sharp "hangover" correction in 2022 and 2023 where shipments plummeted.

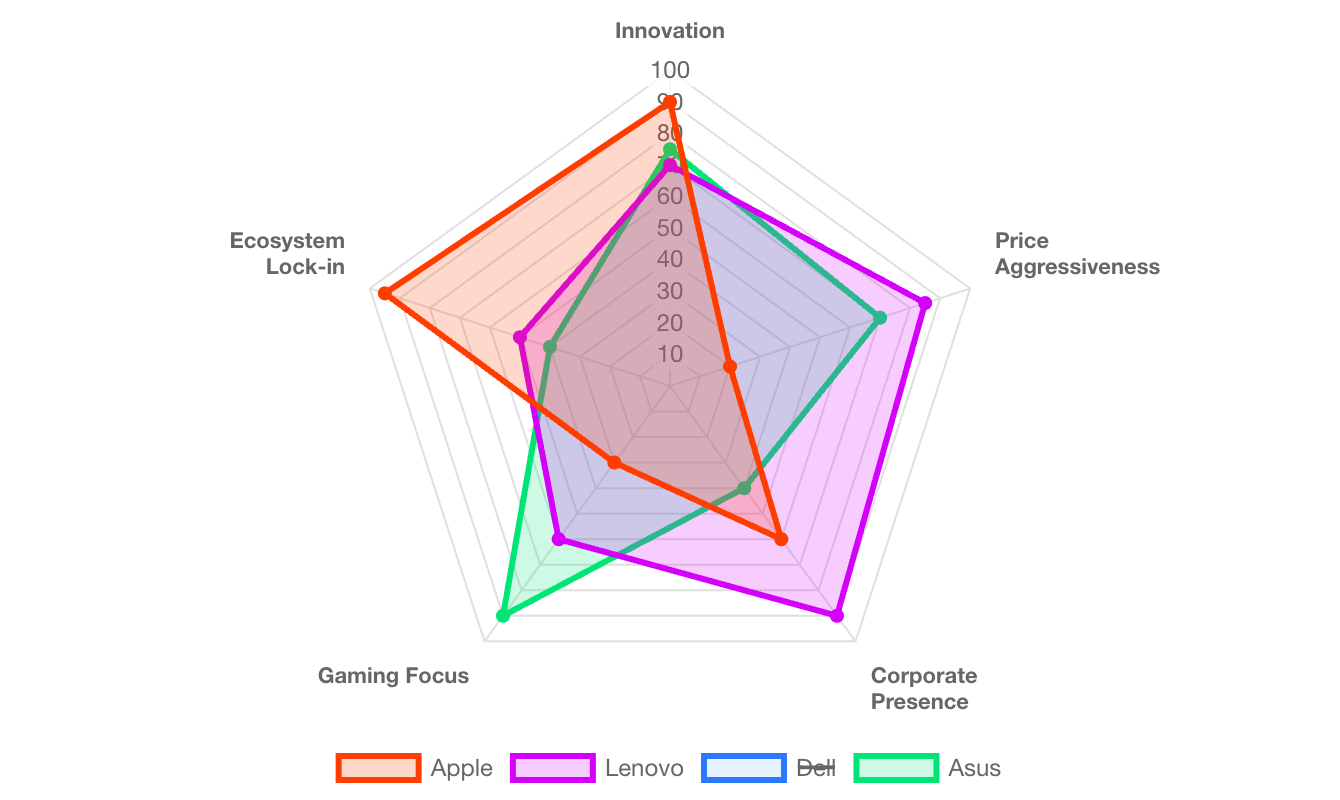

Brand Attribute Analysis

A comparative look at where each brand focuses its energy.

Innovation: R&D investment and new feature adoption.

Price Aggressiveness: Focus on budget/value segments.

Corporate Presence: Penetration in B2B/Enterprise.

Gaming Focus: Brand equity in the gamer community.

Ecosystem Lock-in: Integration with other devices/services.

AI Market Intelligence

Powered by Gemini✨

Simulate 2025: The AI PC Revolution

Use Google's Gemini AI to analyze the 2014-2024 trend lines and generate a strategic forecast for 2025. Will the "AI PC" hype shift market share? Will Apple's M4 chips disrupt the enterprise dominance of Dell and HP?

Global PC Market Forecast 2025: Recovery and AI Segmentation

The market will rebound modestly (4-6% YoY growth) driven by mandatory Windows 10 end-of-life cycles and initial AI PC commercial deployment.

* The Big 3 Consolidation: Lenovo will solidify its lead (25.0%), leveraging aggressive supply chain management for commercial AI volume. HP (20.5%) and Dell (16.0%) will face sustained pressure, maintaining share through services and commercial refresh deals.

* AI PC Impact on ASP: Average Selling Prices (ASPs) are projected to rise by 4-6%. This inflation is fueled by the new baseline requirements (NPU inclusion, 16GB minimum RAM) and the premium tiering of AI-enabled hardware.

* Dark Horse Prediction (Apple): Apple will rapidly widen the revenue-share gulf. Already leveraging optimized M-series silicon, they are perfectly positioned to benchmark the premium AI experience, securing the highest ASP gains among major OEMs.

Conclusion

The 2014-2024 decade was defined by the survival of the fittest. While Lenovo, HP, and Dell solidified their positions as the default choices for the world's workforce, Apple carved out its own lucrative ecosystem. As we move into the AI PC era of 2025 and beyond, the battleground shifts from hardware specs to intelligent integration.

以下是來自notebooklm繪製的infographics

尼古智人 Newsletter

Join the newsletter to receive the latest updates in your inbox.